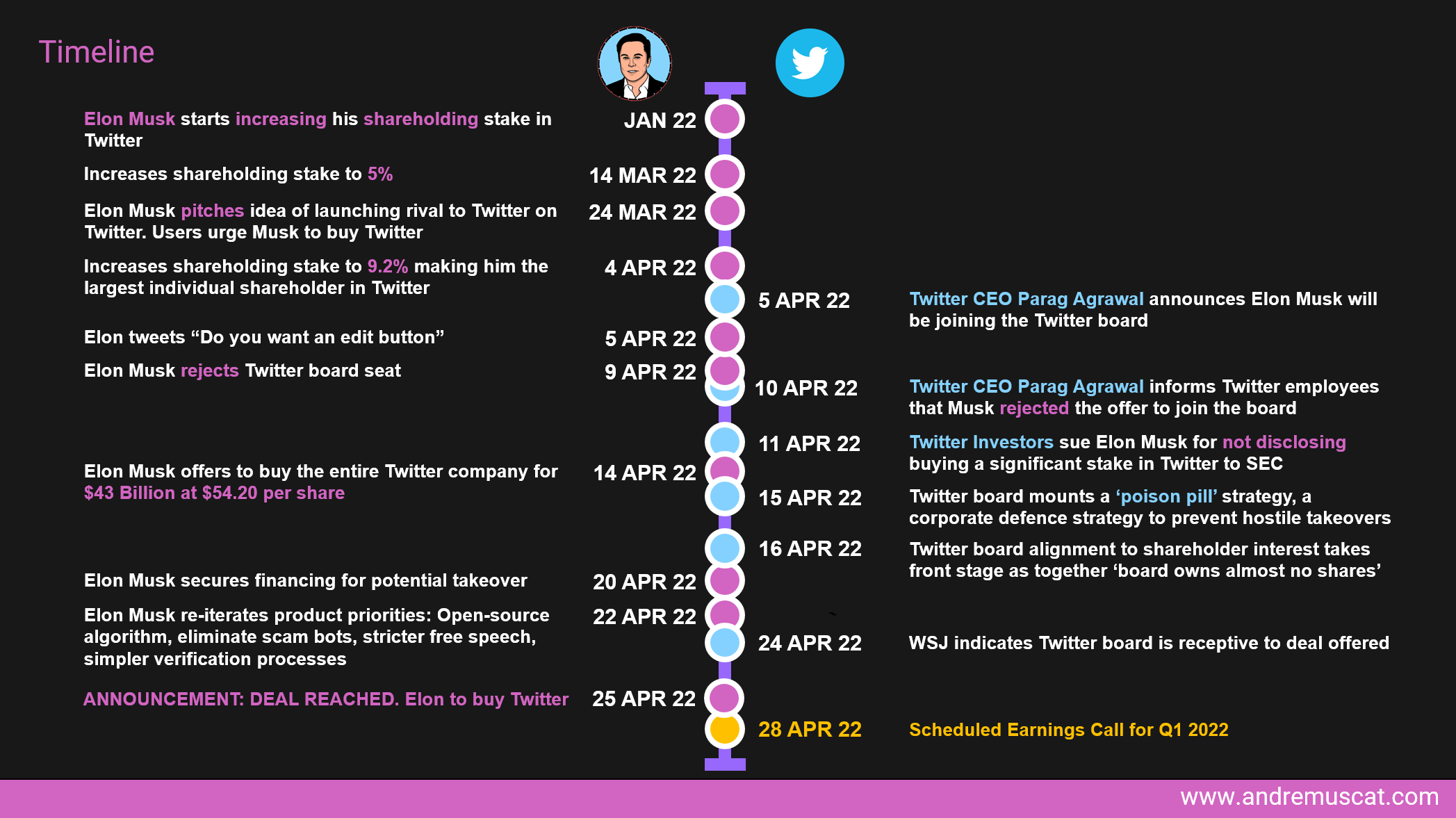

To answer this, you need to understand how each move by Elon Musk was highly intentional, well planned and timed. Focus on the timings of events etc. You will see its brilliance:

- from the moment he started buying stock...

- to the moment the world realised he owned 9.2%...

- to the moment he made the offer of 54.2 USD per share and ...

- gave the board a month before their earnings call on the 28th of April to explain how their performance and direction are better than the compelling offer he put forward.

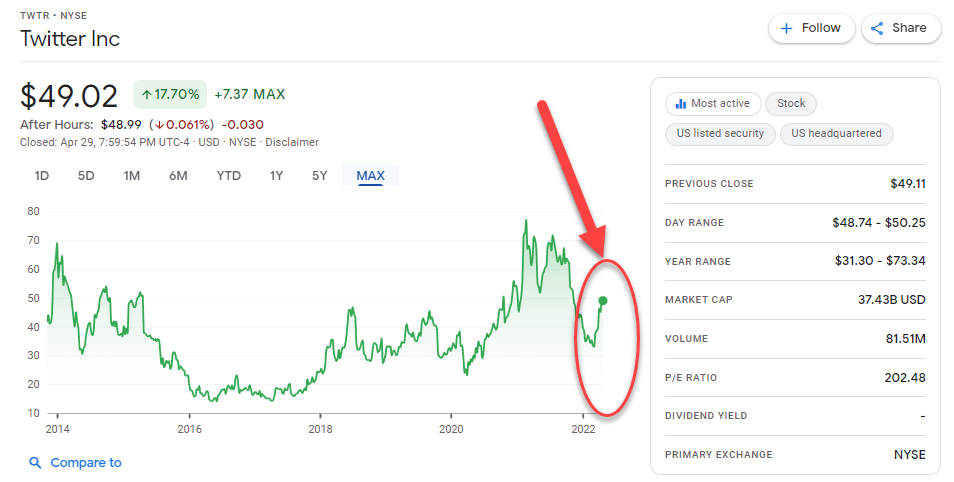

REMEMBER THIS DATE: April 28th: Earnings Call 2022 Q1

You also need to understand the various stakeholders involved in this dance:

- Twitter shareholders

- Twitter leadership & Board

- Partners/Vendors/Advertisers

- Public engagement and End-users of the apps

- Twitter Employees

He and his team devised a solid plan to win the deal that influenced the perceived majority of stakeholders to WANT and NEED this deal to come through.

Step 1: Get in a position of public notice to use as leverage (otherwise said - the eyebrow effect...)

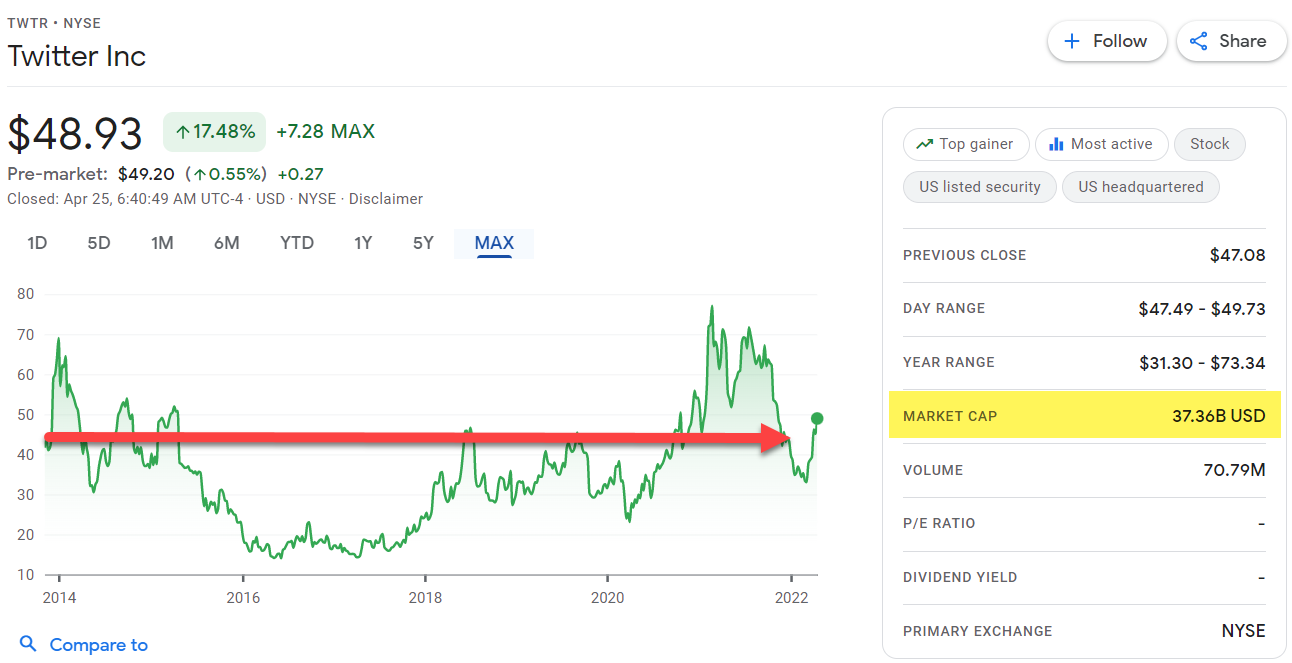

In January 2022, Elon Musk started buying Twitter shares at the 35 - 45 USD stock price. This range is the SAME average stock price range the company mostly traded at in the past 10 years.

He acquired a significant 9.2% of share-holding, becoming (at the time) the company's largest shareholder.

Technically this is typically done when you have full belief in the strategy of the company leadership. If Elon Musk believes in this company, it must have a bright future.

The message would be that if Elon Musk does not believe in the company's future, then why should we?. The same works if he were to dump all 9.2% of his position (i.e. exit entire shareholding of this company). The exit would massively CRASH the stock price for everyone involved (older investors and recent ones who had bought at the 45 - 73.34 USD range).

When you have a global influencer like Elon, you want him on your side to drive the stock price up!......loss of that support drives the stock price down...WAY DOWN! (Check out: Why is Elon Musk threatening to sell 10% of the Twitter stock a big deal? )

Just look at that spike that happened the moment the people understood that it was Elon investing in Twitter shareholding in January 2022.

Step 2: Gather public support to improve product-value

Engage with the customers of Twitter to discuss and propose critical areas of improvement:

- Put the algorithm that prioritises the news feed on open-source. This would enable people to scrutinise and be better ambassadors for the way news is presented to people (smart, very smart). This eliminates suspicions of agendas behind news positioning (e.g. work agendas, political angles).

- Improve the value of the news signal/feed by eliminating polluters with a plan (bots and spam, over-censorship to the benefit also of woke, political or other extreme agendas)

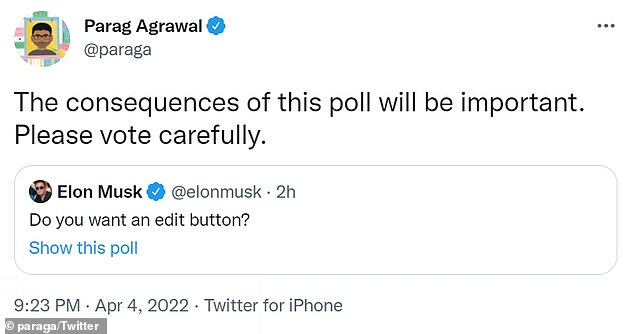

- Enable people to edit (When there are better ways of representing what one was trying to say) - addressing top feature requests around core values.

- Validate that people posting comments are people (not bots), helping people know that this is coming from a person to promote discourse.

Step 3: Frustrate the Twitter board...

Now that Elon had public attention, user attention and shareholder attention, it is time to involve the Twitter board...let's remember that by this step, he was still positioned as a "passive investor".

On April 5th, reports started emerging where the Twitter board offered a board seat to Elon Musk, SUBJECT TO an agreement that Elon would not purchase at any point a shareholding amount greater than 15%.

I remember thinking, WTF, and as I thought about it...it became the preservation of the board and status quo battle. Why make these limitations unless you know that Elon has no intention of being passive, and even more, you know you are not doing well against the standards/performance that this man will bring to the attention of everyone.

On 9th April, as expected, Elon Musk rejected the Twitter board seat, making his real target crystal clear...I WANT IT ALL.

Step 4: Give space to the world to realise how badly Twitter is being run!

By this point, a broader set of people started following and understanding the company's operational effectiveness. What was brought forward was a board that represented:

- Stock price performance over 10 years that is near-flat (swinging around the average 35 - 45 USD range).

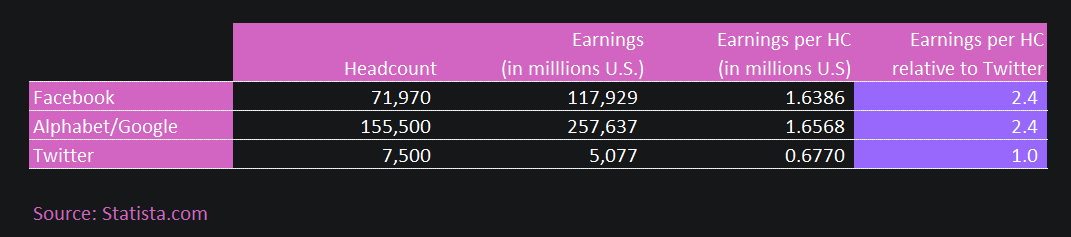

- Revenue per head is 2.4 times smaller than similar companies

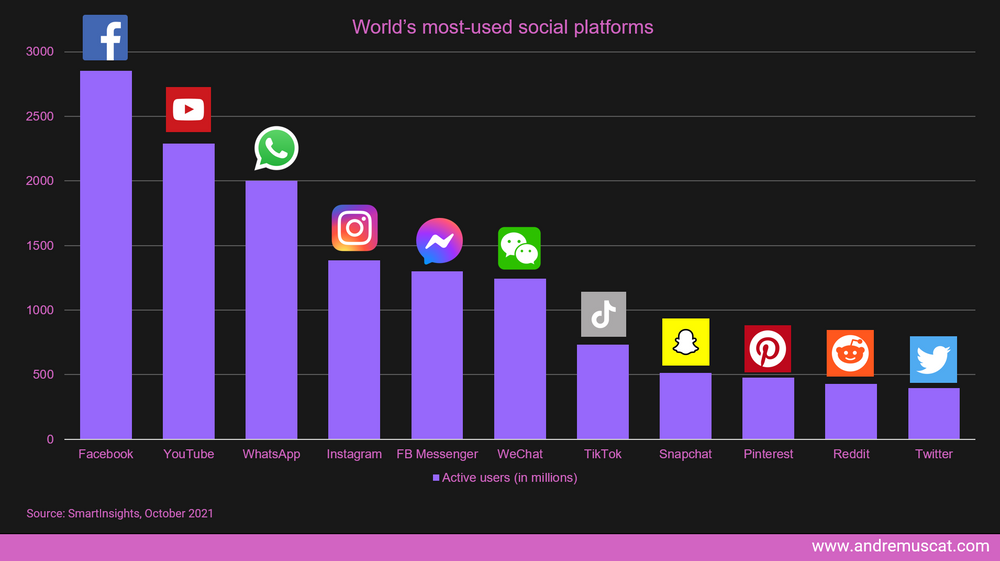

- The number of monthly active users heavily lags behind competitors such as Facebook, Youtube, Whatsapp, Instagram, Tik Tok, Pinterest and Reddit

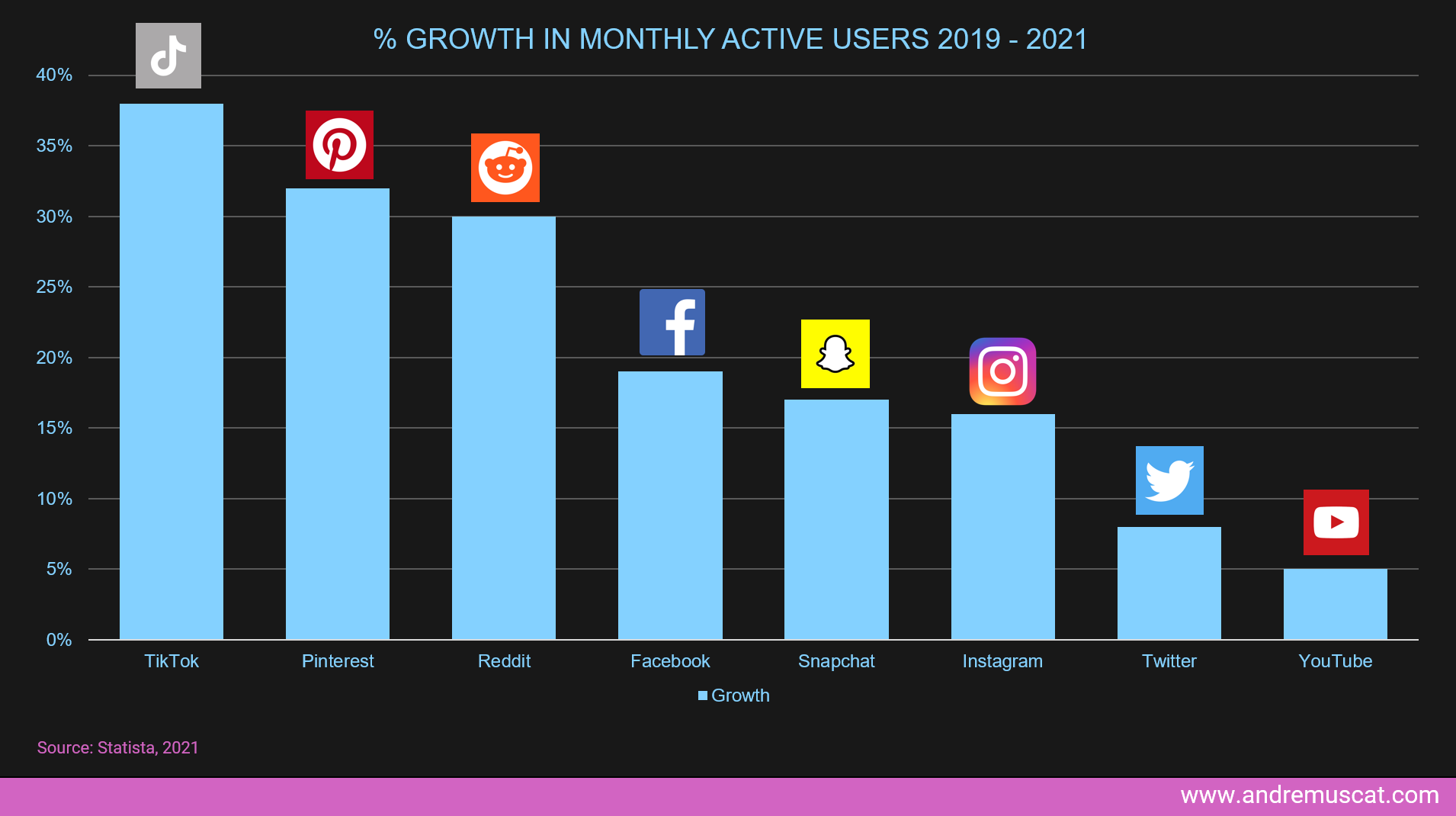

- % Growth in Monthly active users is smaller than its key-competition

These numbers are tragic compared to outcomes achieved by similar companies. Check out Exploring both sides of the Elon-Twitter takeover bid for a deeper analysis of these.

Step 5: Make a compelling offer that cannot be refused...

REMEMBER The stock price over the past 10 years traded around the range 35 - 45 USD.

On April 14th (16 days before the earnings call scheduled for the 28th of April, 2022), Elon Musk offered to acquire the entire company and take it private at a price per share of 54.2 USD.

This is a MATERIAL upside for anyone who purchased in the range 0 - 45 USD range while giving a reasonable value add to those who bought in the 45.1 - 54.1 range. (Cyan, Yellow and Purple areas below)

This leaves a small cohort of people and shares traded between 54.3 and 73.34 USD.

In his offer, Elon set the final price he was interested in transacting per share. This CEILING prevented a stock run-off/rally.

Step 6: Confirm your ability to buy

On April 20th 2022, Elon submitted to the SEC that he had secured USD 46.5 billion in financing to acquire Twitter. The funding to acquire Twitter will be composed of:

- 25.5 billion in debt and loan agreements with Morgan Stanley and “other financial institutions” (unnamed)

- “Equity Financing” commitments by Elon himself are expected to be approximately in the range of 21 billion

https://www.sec.gov/Archives/edgar/data/1418091/000110465922048128/tm2213229d1_sc13da.htm

This means Elon is publicly confirming he has financed the money needed to transact and acquire Twitter to become his asset.

Step 7: Set the spotlight on the Board...and sit back...

By now, Elon has publicly:

- Positioned long-requested improvements to the product.

- Influenced and engaged public sentiment (shareholder and product user).

- He got public acknowledgement on what is majorly wrong with the product experience (Bots & Spam, Edit capabilities, Ability to validate people etc.)

- Showcased how he is a heavy primary user of the product and has better product experience knowledge validated by user feedback (compared to anyone on the board).

- Established, he has a vested interest in the success of this company as a shareholder.

- Reminded shareholders of their sub-standard return on investment (ROI) in Twitter over the years (compared to their returns should they have invested elsewhere).

- He set a purchase price that is a reasonable price for the vast majority of the current shareholders, leaving a tiny cohort of people at a loss.

- Positioned the board as a group of individuals that may be more interested in saving their board member fees, job security and protection of the Twitter status quo over the prospect of making decisions for the company's benefit. (While this can be unfair, that is the overarching outcome...). This implies a conflicting position on their fiduciary duties. This also suggests setting the stage for making the board susceptible to being sued in the courts of law for acting against the shareholder interest.

- Let the board shoot themselves in the foot by supporting the above hypothesis when they took up the poisoned pill strategy to delay further shareholding acquisition by Elon Musk.

- Established that he has a plan to make Twitter a critical social platform for the future by being ready to invest billions into the company.

- Sowed the seed in investor and public heads that he has a bolder, better and more achievable successful plan that what the board may have (both in terms of operational effectiveness and product value)

- Confirmed his financial readiness to acquire at a set price with value deliverable to the vast majority of shareholders.

WOW, WHAT A POSITION!!!

Step 7: Board Options...

By this stage, the board had only three options left.

- Option 1: Show the world that their plan of action has higher potential returns in the short-medium term to shareholders. This was a weak argument given the 10-year track record (not impossible, just weak).

- Option 2: Shop around and find an alternative buyer to Elon Musk.

- Option 3: Accept Elon Musk's offer as the most compelling offer in the short-medium interest of shareholders.

By this stage, the date is April 22nd, and there are only six days left to the 28th, April earnings call. All eyes would be on the board, showing why their engagement of the poison pill strategy is in line with a better strategy than that as available by Elon Musk. This means they only had six more days to find an alternative acquirer aligned to their way of working (demonstrably sub-par), leaving things as-is at an EQUAL or BETTER price than Elon (which was already above market rate).

This means that by this stage, Elon Musk built a compelling case for the board of Twitter to sell and the shareholders to have a compelling reason on why the board should sell.

Again, remember they have an earnings call scheduled for the 28th of April, 2022, and if they fail to provide a compelling demonstration of abilities, all indicators were towards them being individually held liable. O

In Conclusion, parting thoughts

Elon and his team perfectly timed, managed and influenced everyone ranging:

- Public interest

- Shareholder interest

- Board pressure

In the end, they timed this to perfection. On the 25th, the board nodded in approval to the deal. The dynamics of the communications for the 28th of April got set. I fail to see how this board would have survived the onslaught based on the KPIs they shared on the call on the 28th of April.

Soon Twitter will be an Elon Musk company. It may take six months, and there will be pockets of resistance. However, let's stick to basics as the opposition has really weak holding points to prevent impending changes from coming their way.

Related articles: