There are various reasons individuals, entrepreneurs, intrapreneurs, boards and executives compel owners to sell their companies in part or whole.

No matter the process and drivers behind this selling event, the finality of selling always delivers a great shock to your team, who may not fully understand the drivers behind such a critical operation (whether you are on the buying side or selling side).

Even more, the reasons why businesses want to buy something or get sold can be pretty diverse, ranging across:

- Personal

- Situational

- Logistical

- Opportunistic

Identifying these drivers and articulating them helps people align, embrace change faster, and move on.

Why do businesses buy other companies?

Let’s start by getting a sense of why companies buy other organisations:

- Increase profits

- Increase the value of their organisational asset (expanding product lines or feature capabilities, customer reach, go-to-market capabilities, velocity to the market at returns supporting their mandate etc.)

- Increase market attractiveness and market share

- Increase customer stickiness by providing additional value

- Better financial reporting KPIs

- Expand cross-sell opportunities

- Consolidate position in the market

- Improve systems and ways of work

- Access economies of scale through better operational capabilities

In summary, a buyer is typically interested in how your assets can help them grow the value of their assets in terms of:

- Market Share

- Systems of work

What is the seller selling?

Owners can sell various aspects of their ownership:

- The entire business

- A majority stake

- A minority stake

Who is the buyer?

There are also different audiences who may be interested in buying your stake (or portion of it) to:

- Banks (loans)

- Angel / Personal investment from high net worth individuals

- Peer-to-Peer / Crowdfunding (e.g. kickstarter.com, Indiegogo.com, GoFundme.com)

- Private Equity/Venture Capital

- Bonds / Initial Public Offerings (IPO)

Each of these has different parameters against which they will measure the attractiveness of your business to them. In addition, each of these has different growth expectations and ways of doing business. It is essential to know which one you are dealing with to adapt your approach in interactions and work.

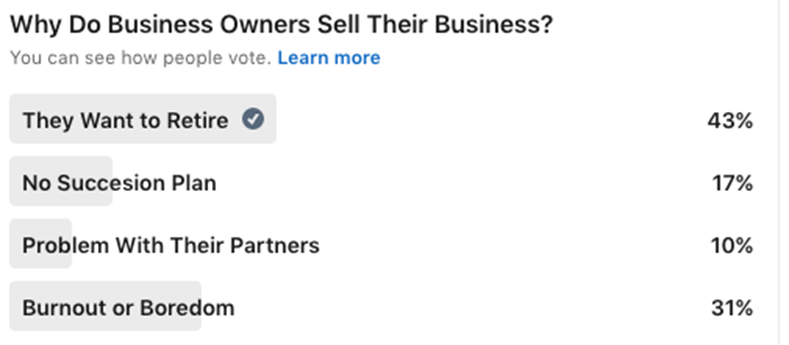

21 Individual/personal drivers to sell

Without trying to be exhaustive

- Cashing out - Pulling out their investment capital after years of hard work

- Relocation

- They want to retire

- Lifestyle change to ill health or life events

- Struggling performance/limiting personal damage (a.k.a, cutting your losses)

- New opportunities to venture into (new market/sector/industry)

- Change in personal circumstances (inherited wealth, Divorce)

- Illness or death

- Burnout / overworked

- Boredom

- Fed up with the headaches of dealing with employee/business issues

- Harder to maintain and win new business

- Lack of Vision and Inflexibility (“this is how we have always done it”) to change

- Partnership tensions and disputes

- Diversify wealth distribution

- Focus on one aspect of the business over another

- Ready for a new challenge

- Desire for a simpler life

- More time with family

- Succession Planning

- Receiving an offer that cannot be refused

Recently, Sebastian Amieva ran a LinkedIn post crowdsourcing a view on why business owners sell their business:

26 Investment/corporate drivers to sell

- Needs differentiated leadership to grow further

- Leadership style alignment to business maturity. Running a startup requires different approaches and techniques to running a medium-sized operation and is radically different from an enterprise-sized company)

- Changes require more senior/established/experienced leadership

- Shifting market fit needing a more significant investment

- Not making enough money

- Diminishing market demand

- Scale the business by merging with organisations that have complementary capabilities and value (1+1 = 3)

- Hindered ability to operate and manage the business effectively

- Industry Changes

- Lack of confidence in the future using current ways of doing business

- Increasing regulatory demand

- Negative trends and economic downturn

- Strong, increasing competition/emergence of new players

- Business Has Reached a Peak

- Declining Profits and fundamental business KPIs

- Loss of important clients

- Loss of human capital

- Change in business environment needing massive strategy shifts

- Need to internationalise or relocate the business

- Consistent income figures (with challenges to grow)

- Expand product line, territory

- Focus on an area of the business (spinning off the other)

- Litigation

- Investment Risk reduction

- Business is Struggling

- Up economy or market favourable to sell now

Wrapping up

Engaging in mergers and acquisitions (M&A) is exciting, change leading and creates massive opportunities for learning and growth.

In this post, we explored 47 reasons why profitable businesses sell their assets. Of these, 21 are individual, and 26 are corporately driven.

Understanding the drivers behind why the seller is separating from their asset and aligning to the motivation driving the buyer’s thesis enables you to align, drive change and understand how to maximise the opportunities to realise the value of the transaction faster and better.